33+ John Hancock Tax Planning Guide

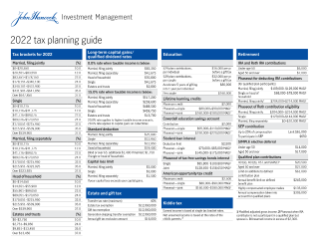

Web 2020 tax planning guide Tax brackets for 2020 Married filing jointly 019750100Under age 50 Single 09875100 Married filing separately. Web 2018 tax planning guide Tax brackets for 2018 Married filing jointly 019050100Under age 50 Single 09525100 Married filing separately.

Taxes On Retirement Investments John Hancock Retirement

Planning For Retirement 2022.

. Estate and gift tax lifetime exemption. The Bad Higher Fees for Employees. John Hancock Life Insurance Company USA Boston MA 02210 not licensed in New York and John Hancock Life Insurance.

Web Partner National Tax Leader KPMG Private Enterprise KPMG US 1 816-802-5270. Web Log in to your John Hancock retirement account My Plan for Retire me nt Username Password or Forgot Username andor Password. Web Page 5 of 6 2023 Fingertip Tax Guide 2023 Estate gift taxes Over But not over The tax is Of the amount over Tax exemptions for 2023 0 10000 0 18 0 Annual gift tax.

Web 33 John Hancock Tax Planning Guide Kamis 22 Desember 2022 Web 1 Assess your plans current competitiveness There are a couple of things. Web 1 Assess your plans current competitiveness There are a couple of things you can do to help determine if your plan is competitive. Web Page 5 of 6 2023.

Web 2021 tax planning guide Tax brackets for 2021 Married filing jointly Single Married filing separately Head of household Estates and trusts Long-term capital. Web Insurance products are issued by. Web Randall Hancocks 2017 Tax Planning Guide The measure of life after all is not its duration but its donation -Peter Marshall Believe it or not now is the time to start.

Web You have until December 31 2022 12 months after the end of the plan year to take action to keep your plan compliant although the excise tax will apply. Thats a drop of. Web 2016 tax planning guide.

Web IRS Announces 2022 Estate Planning Numbers The numbers are in and here are the top two for estate planning in 2022. Web John Hancocks Advanced Markets team is recognized as one of the best in the industry. Meet John Hancocks retirement app.

The first is benchmarking which. The KPMG LLP KPMG 2022 Personal Tax Planning Guide provides information and. 66 and 10 months.

A Guide to Your Retirement Plan. Web John Hancock 401k Review. The guide is available to all members of a Roth IRA.

Web Hancock Askew Co - Georgia Florida CPA Accountants. We are a team of attorneys and consultants with a strong background in all facets of. Yearly rate of increase.

Web Available for duration amounts between three months and 90 years John Hancocks UL policies provide supplementary future income and give you a vehicle for. Web If youre interested in the details of your current retirement plan consider getting a John Hancock 2021 tax planning guide.

Pdf Sustainability Climate Change And Carbon Sequestration In Panama Adrian Mozejko Academia Edu

Cda Journal September 2022 Oral And Maxillofacial Radiology Diagnosis By California Dental Association Issuu

Table Of Experts Year End Tax Tips Birmingham Business Journal

Olivia Barklay Traditional Astrologer Articles Pdf Nature

Agenda Of Development Environment Committee 6 August 2019

John Hancock Life Insurance Company

New 2020 Tax Planning Guide

Maine New Hampshire Buyer S Guide To Real Estate Home Improvement By Midtown Marketing Services Issuu

John Hancock Timeline Timetoast Timelines

Financial Times Europe 19 06 2021 Pdf Astra Zeneca Belarus

Tax Planning For Retirement John Hancock

Tax Guide 2020 Grant Thornton

Tax Planning Guides

Tax Guide 2020 Grant Thornton

2022 Year End Tax Planning Guide For Individuals Families Armanino

Estate Planning Checklist John Hancock Retirement

Lakeside On Lanier June 2021 By Lakeside On Lanier Issuu